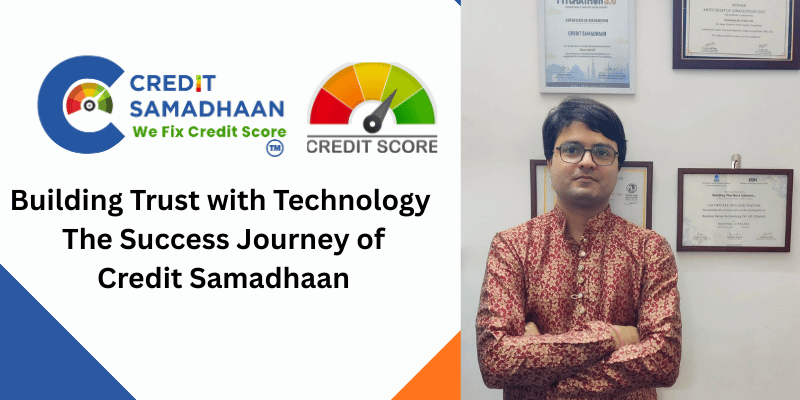

In Indore, a quiet movement is unfolding — not with grand marketing or loud campaigns, but with simple technology and a human touch that’s changing lives across India.

From Childhood Struggles to Building Solutions

This is the journey of Piyush Nagar, who lost his father at just 8 years old. To support his family, he worked small jobs like selling ice candies, while never giving up on his studies. His hard work led him to become an engineer and later the founder of Sixth Sense IT Solutions, a tech company serving more than 4,000 clients globally.

But even with this success, Piyush couldn’t ignore one troubling fact:

Why are honest, hardworking Indians denied loans, not because of fraud, but simply due to their credit scores?

The Discovery That Sparked a Vision

While working in a village, Piyush saw that out of 1,00,000 loan applications, nearly 99,300 were rejected for poor credit scores. These applicants weren’t irresponsible — they just didn’t know how credit scores functioned.

That realization became the foundation of a new mission: Credit Samadhaan.

What Credit Samadhaan Does

Credit Samadhaan is an AI-driven platform that carefully scans credit reports, identifies errors or weaknesses, and provides step-by-step strategies to repair credit health. Many users begin seeing improvements in as little as 45 days.

But the mission didn’t stop with technology alone.

Taking Help to the People

To make financial guidance accessible, Piyush established Credit Samadhaan Kendras in 18 states. Here, trained Credit Coaches assist farmers, small business owners, and families in understanding and improving their credit.

These Kendras are more than service points — they also generate employment by training locals to become Credit Coaches themselves, turning communities into hubs of financial empowerment.

Impact Beyond Numbers

Poor credit scores affect lives in ways that go far beyond bank rejections:

- Farmers can’t secure funds for cultivation.

- Shopkeepers are unable to expand their businesses.

- Families end up paying higher interest on home loans.

Credit Samadhaan is rewriting these realities, giving people not just better credit scores but renewed confidence and dignity.

Recognition and Growth

In a short span, Credit Samadhaan has earned strong recognition. It has received support from IIM Ahmedabad, IIM Bangalore, and STPI, won awards like Octane 5.0 and Bharat Pitchathon, and was ranked among the Top 50 Social Enterprises by the Tata Social Challenge.

With backing from Inflection Point Ventures, the platform is growing rapidly to reach even more people.

A Mission with Heart

For Piyush, Credit Samadhaan is more than business. He understands that rejection often leaves people hopeless, sometimes leading to stress or even depression. His mission is to:

- Reduce financial stress.

- Prevent tragedies linked to debt.

- Give people second chances to rebuild their future.

The Road Ahead

With over 1,000 clients and 464 partners already, Credit Samadhaan is expanding its reach with one vision: to ensure no Indian is left behind due to a low credit score.

More Than a Startup, A Movement

This is not just about improving credit. It’s about giving people hope, dignity, and a fresh start.

Through Credit Samadhaan, Piyush Nagar is showing India that technology can do more than generate profits — it can heal, empower, and create opportunities for millions.

👉 Learn more at: [www.creditsamadhaan.com]